Two, 4, Six, Eight! Maximize and Recognize!

This text is the second in a three-part collection that evaluations a number of the main issues in getting ready for observe possession transition and complete retirement planning. Within the earlier article, we mentioned the 2 commonest methods through which a dental observe is offered and 4 methods to maximise your observe’s worth. This text will share six essential themes that create a framework to maximise your wealth and reduce your threat.

SIX… There are SIX vital themes to think about if you wish to be prepared:

Imaginative and prescient and values are the cornerstones of a strong monetary plan. When dentists decide what underpins their long-term targets, implementing a plan and correcting course within the face of a problem turns into much less cumbersome. Optimizing funding portfolios is an integral a part of the journey towards reaching your monetary targets. Whether or not you’re a younger dentist beginning out or transitioning out of possession, reviewing your funding portfolio’s suitability and efficiency is important. Alongside the identical strains, reviewing your insurance coverage portfolio in accordance with your wants, circumstances or threat profile gives peace of thoughts for a spread of potential outcomes. Your insurance coverage wants adapt as you progress by completely different profession levels, so it’s important to make sure that you could have the protection that fits your distinctive context. And, lastly, environment friendly tax structuring can contribute towards reaching monetary targets by contemplating your loved ones’s particular circumstances. Whether or not your monetary portfolio consists of firms, trusts, or employed people, guaranteeing that taxation is appropriately and effectively structured can contribute towards reaching monetary targets.

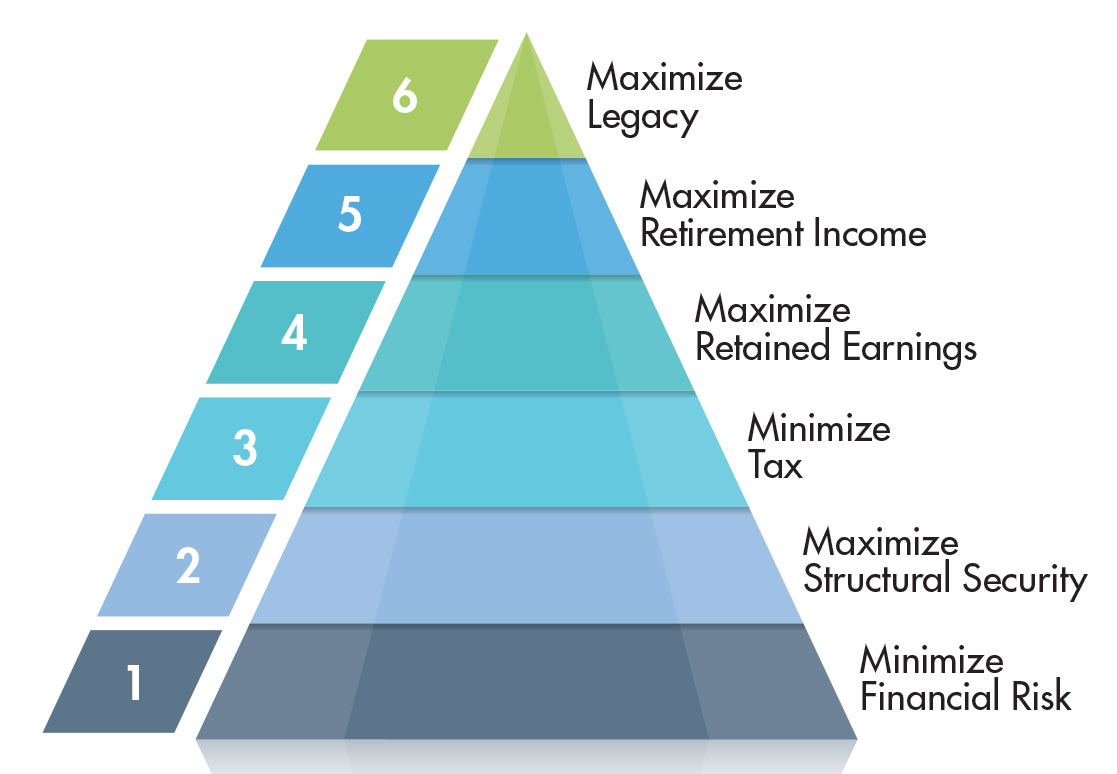

Farber Wealth has developed a useful needs-based framework that illustrates six “Crucial Themes” that create a framework to maximise wealth and reduce threat.

- MINimize Monetary Danger

- MAXimize Structural Safety

- MINimize Tax

- MAXimize Retained Earnings

- MAXimize Retirement Revenue

- MAXimize Legacy

Themes 1 and a pair of type the muse of your monetary future. The muse of any skilled’s monetary plan must be the safety of your best asset – your well being. Contemplate what the unintended penalties could possibly be for your loved ones or the impression in your observe in the event you overlook this very important space. What would the monetary impression and ensuing stress be if considered one of your loved ones members contracted a significant illness? Have you ever made provision for shielding your family’s month-to-month revenue in case of short-term or long-term incapacity? Have you ever thought-about offering for the overhead prices of working the observe in the event you aren’t there for a time due to an harm or sickness? Within the case of dying, what measures should be in place to satisfy your loved ones’s monetary wants and keep their way of life; to not point out paying off any money owed of the observe? As for constructions – though chances are you’ll be restricted by regulation – have you ever thought-about your choices as a way to profit from your Skilled Company? Do you could have an up-to-date Will and POA paperwork? Do you could have a second Will for the observe? Are you conscious of the price of failing to do these items?

Themes 3 and 4 turn into more and more essential because the observe grows. Minimizing tax turns into a life-long battle that requires diligence and planning, not solely year-over-year but additionally with a longer-term viewpoint. It’s brutal what the assorted ranges of tax extract from our pockets over a lifetime. Taking a while together with your advisors to map out methods to reduce it on an ongoing foundation is critically essential. As the straightforward analogy goes: it’s relatively pointless pouring much more water in to fill a bucket that’s riddled with holes. Higher to determine methods to repair the holes! MAXimizing Retained Earnings refers to, amongst different issues, studying to pay your self first from earnings – taking a few of it “offline” and investing it in your future. Along with this, it’s studying methods to put money into property by your company that don’t entice tax – both whereas rising or when being extracted. The federal government has taken many tax-reducing alternatives away so it’s essential to know essentially the most highly effective methods that stay.

Theme 5 is planning for retirement. As talked about earlier, timing and motivation for a observe proprietor to step away from observe possession or retire fully from dentistry differ for every particular person dentist. Some could select to scale down fully, go part-time or proceed to work full-time. By planning for this choice early on, households can have the monetary freedom to make the suitable choice on the proper time. A key consideration here’s what worth you want in your funding to help the retirement possibility that matches finest for your loved ones, and what’s your quantity that you just consider you want from the sale of your observe as a way to retire in your phrases.

The sixth Crucial Theme is to MAXimize your legacy. Finally, it’s about how your loved ones’s wealth could also be impacted and what protecting measures should be in place. A lot consideration is given right here to the impression of revenue tax, whether or not on the assorted types of funding (company or private), and, in the end, in your property, the place typically the most important single “donation” to the CRA is made. Your advisors should be well-versed in all issues “tax” and perceive what you are able to do to cut back and even get rid of the impression of tax upon your final passing. You’ll be able to know that you just’re leaving a significant legacy – whether or not to household, charity or each – and writing Ottawa proper out of your Will. Now that’s value contemplating!

All through the six vital themes, dentists and their households are inspired to suppose clearly about each the meant and unintended penalties that will happen in the event that they don’t have a strong monetary plan in place. The target is all the time to make use of your loved ones’s targets as a place to begin and to empower you with the data and instruments to trace and obtain these targets.

Having reviewed the 2 methods a dental observe is offered, the 4 methods to maximise observe worth, and now the six vital themes to think about maximizing wealth and reduce threat, the following and remaining article on this three half collection will evaluate eight keys to a clean transition.

Concerning the Authors

Philip Evenden is a Director with the Wealth Administration observe at Farber. His focus is on superior monetary planning for the profitable – lively or retired –entrepreneur. pevenden@farbergroup.com

Philip Evenden is a Director with the Wealth Administration observe at Farber. His focus is on superior monetary planning for the profitable – lively or retired –entrepreneur. pevenden@farbergroup.com

Dr. Sean Robertson is a licensed dentist and founding accomplice of The Dental Dealer Crew, a full-service appraisal, sale and transitions agency for dentists. Attain him at sean@dentalbrokerteam.com.

Dr. Sean Robertson is a licensed dentist and founding accomplice of The Dental Dealer Crew, a full-service appraisal, sale and transitions agency for dentists. Attain him at sean@dentalbrokerteam.com.