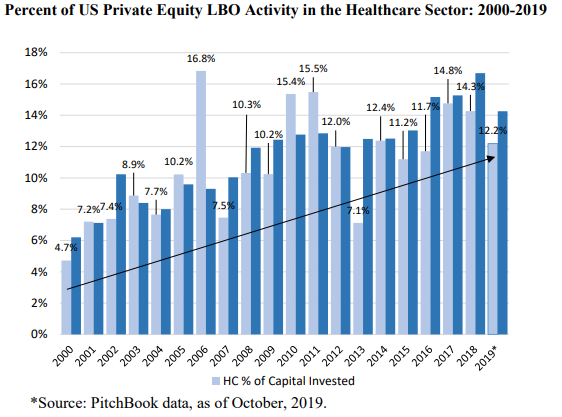

Non-public fairness investments have grown in well being care lately. Based on Appelbaum and Batt (2020), whereas in solely 4.7% of leveraged buy-outs (LBO) had been in well being care in 2000, that quantity had risen to 12.2% in 2019.

A 2022 white paper finds that investments in well being care have risen much more:

The variety of offers rose 36% to 515, up from 380 the prior yr. Whole disclosed worth greater than doubled to $151 billion from $66 billion (see Determine 1). The common disclosed deal worth soared 134%, primarily due to 5 buyouts larger than $5 billion, in contrast with simply 1 the yr earlier.

The 5 largest offers in 2021 included purchases of Medline Industries ($34.0 billion), Athenahealth ($17 billion), Parexel ($8.5 billion), Inovalon ($7.3 billion), Cerba Healthcare ($5.3 billion). Different investments embrace these in “telehealth, digital well being and well being data know-how” in addition to supplier acquisitions.

President Biden is skeptical about non-public fairness investments in well being care and even talked about points associated to personal fairness takeovers of nursing houses in his 2022 State of the Union Tackle. However, it stays to be seen if non-public fairness investments will help present further funds to scale back price and enhance outcomes, or not. Extra particularly, which kinds of healthcare would profit most from non-public fairness investments? We are able to all agree that well being care may benefit from further use of know-how to enhance outcomes and make processes extra environment friendly. Will non-public fairness investments be a method to obtain these objectives? Solely time will inform.