Twelve thousand layoffs at Google. Eleven thousand at Fb; 10,000 at Microsoft; 18,000 at Amazon; 8,000 at Salesforce; 4,000 at Cisco; 3,000-plus at Twitter.

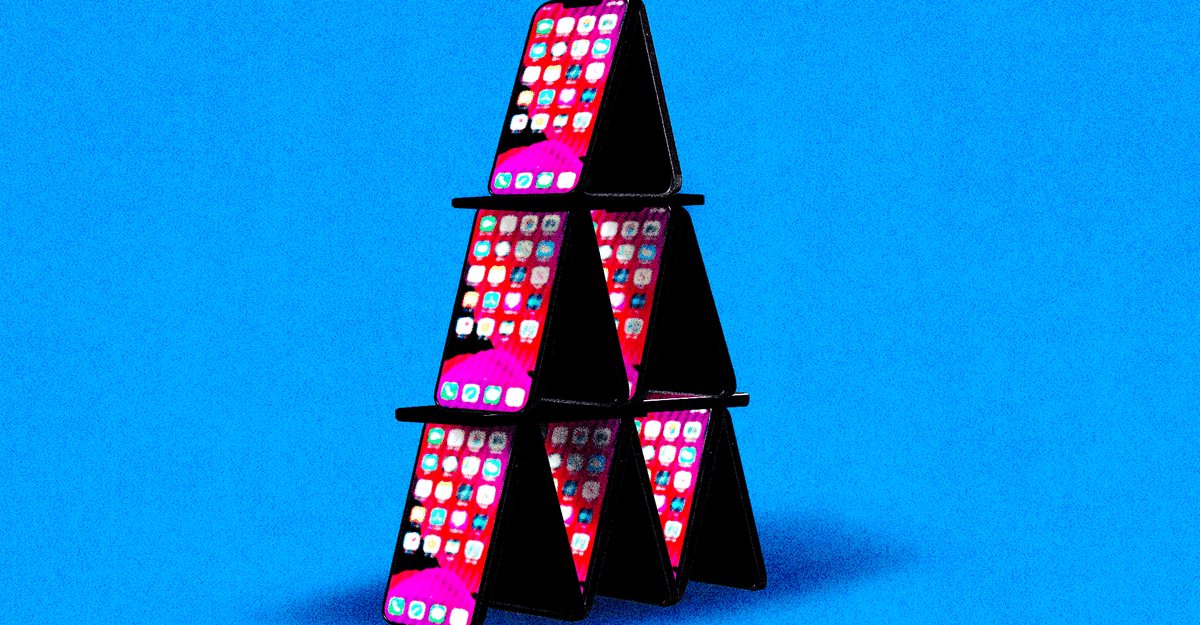

The American economic system has recovered from the sharp downturn brought on by the arrival of the coronavirus and is chugging alongside simply wonderful, a minimum of for the second. But the tech sector—the nation’s most dynamic business—has fallen right into a type of recession characterised by mass layoffs, pervasive hiring freezes, a bear marketplace for tech shares (their current rebound however), a collapse in preliminary public choices, and a sharp drop in venture-capital funding.

For many years, the business’s potential appeared boundless. So why has tech suffered a lot greater than its company friends have these days? That query has two solutions: Federal Reserve Chair Jerome Powell’s effort to stamp out inflation, and the waning of a pandemic emergency throughout which many tech corporations thrived.

The foremost difficulty for tech corporations is rates of interest, which Powell has been mountaineering sharply for the previous 12 months. Quick-term borrowing prices had been near scratch for a lot of the 2010s and fell to scratch once more when the pandemic hit, however they started rising precipitously in 2022 because the Federal Reserve has tried to scale back inflation by slowing down elements of the economic system. Just about all American companies throughout all enterprise sectors are reliant on borrowed money in a technique or one other (as are most American shoppers). However many tech corporations had been particularly conditioned to very low rates of interest: Uber, an unlimited and long-established enterprise, for example, loses cash on many rides, and 1000’s and 1000’s of start-ups accrue enormous losses and depend on their financiers to foot their payments whereas they develop.

The interest-rate hike has hit the tech sector exhausting in one other manner: by serving to crater crypto costs, thus erasing billions of {dollars} of paper wealth, disciplining any variety of enterprise capitalists, and crashing any variety of know-how companies, most spectacularly the Ponzi-like FTX. Certainly, the crypto winter has each straight damage many know-how corporations that went all in on bitcoin or ether and not directly made the financing local weather tougher for others. There aren’t quite a lot of bitcoin decamillionaires round to speculate this 12 months, and plenty of VCs are deep within the pink.

The second main issue is a reversion to the imply after the extraordinary early years of the pandemic. That terrible interval was in some methods a great one for tech companies. Folks stopped going to theaters and began watching extra films and exhibits at dwelling—hurting AMC and aiding Netflix and Hulu. Households stopped purchasing as a lot in particular person and commenced shopping for extra issues on-line—miserable city facilities and boosting Amazon and Uber Eats, and spurring many companies to pour cash into digital promoting. Firms stop internet hosting company retreats and began facilitating conferences on-line—depriving lodge chains of cash and bolstering Zoom and Microsoft. Faculties despatched college students dwelling—hurting companies that present providers to highschool districts and resulting in a surge in spending on computer systems, tablets, and virtual-classroom software program.

Flush with new income and bolstered by low borrowing prices, tech corporations expanded. They added 1000’s and 1000’s of latest staff: Microsoft, for example, went from a head rely of 163,000 to 221,000, and Meta, Fb’s mother or father firm, from 45,000 to 72,000. Many companies additionally expanded their enterprise operations; Meta, for example, poured billions and billions of {dollars} into creating a virtual-reality social area (that, I might add, no one likes and no one is utilizing).

Shopper spending has since normalized. Gross sales of smartphones, laptops, kitchen devices, and health club tools have dropped, and People are spending much more money in eating places and film theaters and on accommodations and flights. Consequently, many tech corporations have seen revenues in elements of their companies decline, and company officers are admitting that they expanded too rapidly. “Our productiveness as an entire isn’t the place it must be for the pinnacle rely we’ve,” Sundar Pichai, the pinnacle of Google’s mother or father firm, instructed workers final 12 months.

The web result’s that tech corporations whose prospects as soon as appeared limitless now look a bit extra like different outdated, lumbering company giants. There’s some excellent news for tech companies, although. Many are nonetheless wildly worthwhile. The Fed is more likely to cease mountaineering rates of interest quickly. Synthetic intelligence has began making superb breakthroughs—ones that common shoppers can lastly perceive, see, and use. Possibly a tech summer time is simply across the nook.